What South Africans did with their money in 2025

Credit continues to play a central role in South Africans’ financial planning.

Image: Pixabay

South African households closed last year in slightly better financial shape than expected, according to TransUnion’s latest Consumer Pulse Study, but financial pressures remain.

While almost half of respondents to the fourth quarter 2025 survey said their household finances were better than planned, 36% anticipated missing bill payments, highlighting the ongoing tension between optimism and affordability.

Credit continues to play a central role in South Africans’ financial planning.

The survey found that 91% of consumers consider access to credit important for achieving their goals, yet only 42% felt they had sufficient access, with 33% saying they did not.

While half believed they would be approved if they applied, just 36% planned to seek new or refinanced credit over the next year.

Credit cards, personal loans, and buy now, pay later (BNPL) services were the most in-demand products, though barriers such as high costs, income concerns, and fear of rejection remain.

“These figures aren’t about poor money habits. They reflect a reality where wages struggle to keep pace with the rising cost of living,” said digital financial services platform Finchoice commenting on TransUnion’s data.

Craig Whittaker, COO, said “credit can be helpful when it’s used responsibly. The danger is borrowing in a rush, without understanding the long-term cost.”

Finchoice also noted that informal lending remains widespread, often exposing vulnerable consumers to far greater risk.

“The key is knowing when to use [credit], and to only borrow from registered credit providers so you're protected along the way,” said Finchoice.

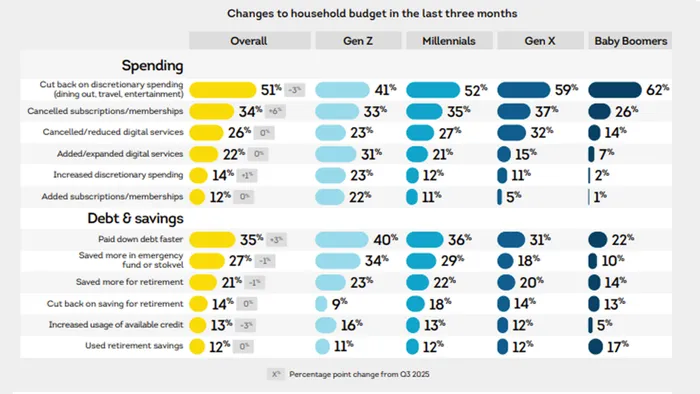

Households also showed signs of adapting to financial strain. Half of respondents reported reducing discretionary spending, 34% cancelled subscriptions or memberships, and 38% planned to increase contributions to retirement funds or investments.

Changes to household budget in the last three months of 2025.

Image: TransUnion

Macro data from PayInc’s November 2025 Net Salary Index shows why some households ended 2025 on firmer footing.

While average nominal take-home pay was largely flat month-on-month at R21,414 in November, salaries were up about 4% year-on-year.

The number of salaries paid in 2025 was roughly 125,000 higher than in 2024, with growth in sectors such as community services, trade, and mining. Inflation, however, continues to pressure real wages, slightly eroding purchasing power despite higher nominal pay.

Taken together, the findings paint a picture of a population navigating financial strain with a mix of caution and optimism.

South Africans are making strategic choices – cutting costs, managing debt, and monitoring credit – while still keeping an eye on the future, reflecting both resilience and a growing awareness of the importance of long-term financial stability.

IOL BUSINESS