From the Congo River basin to South Africa’s heartland, modern Chinese mines and smelters now dot the landscape.

Image: Supplied

Deep underground at the TAU Mine, 180 km west of Johannesburg, a young miner welcomes us with a cheerful “Nǐ hǎo!”

He once struggled to make ends meet, but now has become a skilled technician. Not only did he get to build a new house for the whole family with his remuneration, but he also paid for his sister’s education.

Nearby at the CAPM Oni Gold Mine’s West Processing Plant, Weifeng has returned from leave. On a video call, his two-year-old were calling “Dad” from across the world. He smiled, watching the mine he helped build operate day and night, producing gold that has become a hit in the global market.

These moments reflect a larger trend. As the G20 emphasizes inclusive growth, Africa-China collaboration has been proved a successful practice to bring industrial chains and natural resources together. Combining China’s operational skills and Africa’s abundant natural resources, this partnership is creating new opportunities across the continent.

1. 1,734 Meters Underground

A 13-hour flight from Shenzhen to Africa is no new experience to Weifeng. This route has grown busier, manifesting a stronger economic tie between China and South Africa.

It was alomost dawn when the plane landed at the Witwatersrand Basin. Known as the “Earth’s Piggy Bank”, it holds over half the world’s gold reserves and has yielded more than 45,000 tons of gold throughout history.

Weifeng’s employer, Pengxin Resources’ CAPM, is actively carrying out the exploration here. At 1,650 meters underground at the TAU Mine, we witnessed their working process.

More than 2,000 miners worked in kilometers of tunnels underground.

Image: Supplied

More than 2,000 miners worked in kilometers of tunnels underground. They would descend at 16 meters per second in elevators, reaching mining levels in spacious, well-lit tunnels—wide enough to have two cars driving side by side.

Rail tracks line these passages. Miners in protective gear board carts with their equipment; some would have to travel two hours to their stations.

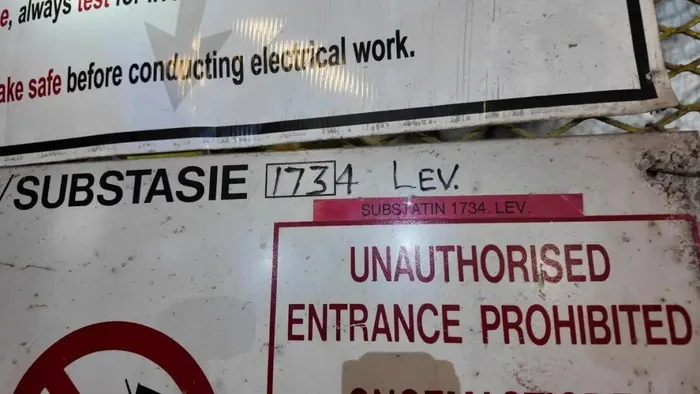

But 1,650 meter underground isn’t the bottom of the mine. At 1,734 meters, loaders were ready to be linked to the surface by a powerful hoist, which lifted 500,000 tons of ore last year.

While 1,734 meters is deep for Chinese miners, it’s not a record for the Klerksdorp.

Image: Supplied

A Gold Town Reborn

While 1,734 meters is deep for Chinese miners, it’s not a record for the town Klerksdorp.

As a key part of the Witwatersrand Basin, Klerksdorp boomed from the 1930s-80s. “At its peak, 48 mines operated here, producing over 600 tons of gold a year,” said CAPM Chairman Li Xuecai. “Hundreds of thousands worked here. The town’s strong infrastructure dates to that era.”

Decline followed as gold prices fell. Now, with prices back at high levels again, companies like CAPM are reviving old mines.

“Closed mines still have rich, untapped veins,” said Warren Freema. “There’s great potential lying down there.”

The West Plant hums with renewed energy, despite the dusty air and ageing equipment.

Image: Supplied

Nearby, a giant mill roars as ore is ground into powder, mixed into a slurry, then smelted. Soon, a 26.4 kg gold bar with a purity of 88% is formed.

“It took three months from restart to the first gold bar,” said Chen. “We were watching over the crucible all the time—with an anxious yet hopeful. That first bar made it all worth it.” The success boosted morale among the more than 2,000 employees.

Restarting the West Plant was a bold step,” recalled CAPM CFO Chen Tao.

Image: Supplied

The whole supply chain is waking up, too. The West Plant hums with renewed energy, despite the dusty air and ageing equipment. New conveyor belts signal a fresh start.

“Restarting the West Plant was a bold step,” recalled CAPM CFO Chen Tao. “After six months idle, the equipment was nearly useless. We replaced key parts first, got production going, then fine-tuned.”

The success boosted morale among the more than 2,000 employees.

Image: Supplied

“Since Q1 2025, the exploration has tripled, breaking records and setting a strong foundation,” Freema added. “Through bonuses and recognition, we’ve built a motivated team—even drawing talent back from other firms.”

Chinese Miners Are Ready

Gold has rallied strongly over three years, topping $4,200/oz by December 2025, a 100% rise. This reshapes central bank strategies and renews interest in Africa’s goldfields.

The boom has revived towns like Klerksdorp. As local miners say, “Above US$3,000, every shaft in town can reopen.” Mines once closed by Western firms are being turned around by Chinese miners through cost control and local integration.

Mining is capital-and-technology-intensive,” said Wang Anfu, CAPM deputy GM and a 20-year veteran in South Africa.

Image: Supplied

“Mining is capital-and-technology-intensive,” said Wang Anfu, CAPM deputy GM and a 20-year veteran in South Africa. “It demands expertise in geology, metallurgy, sales, and managing community and government relations. This is a long-term commitment.”

Chinese firms began this journey over twenty years ago. The Forum on China-Africa Cooperation (FOCAC), founded in 2000, has helped lift relations to a strategic partnership, moving mining cooperation beyond simple trade.

Li Xuecai notes that FOCAC and the Belt and Road Initiative offer policy and financial backing. “Forum-driven policies mean tax breaks and faster approvals. They also help us get favourable loans, key to our confidence in Africa.”

Wang Hetao, Head of Yangtze River Securities Research, identifies two phases. First, post-WTO accession (2000–2010), Chinese firms went abroad for resources like iron ore, but inexperience led to mixed results.

Since 2010, non-ferrous metals firms have taken the lead, successfully running copper, bauxite, gold, and lead-zinc mines in Africa, Central Asia, and South America.

“Chinese miners are now shifting from scale to quality,” Wang said.

This shift fits global sustainability goals. The G20 Johannesburg Summit’s Green Minerals Initiative outlines a fair, open mineral supply chain for the green transition.

Thus, Chinese miners in Africa are not only achieving business success—they are helping foster a new development model for the Global South. From resource security and green mining to cross-cultural integration, they are well-prepared for a new historical phase. Their journey shows how resources can drive development through cooperation—a pragmatic Chinese response in a time of global change. - Chinese Fund News